Heads: Benjamin Jourdain, Arnaud Le Ny, and Étienne Sandier

Fields of research

In the context of computational models, there is an increasing need to develop stochastic models in physics and biology in order to achieve more realistic simulations. For example, in complex fluids such as polymeric fluids, both probabilistic approaches and analytic approaches are used for micro-macro models. Another important example is first-principle molecular simulation, which has become a major tool in chemistry, materials science, molecular biology and nanotechnology. In particular, stochastic models are ubiquitous in molecular dynamics to model the evolution of molecular structures such as proteins.

The combination of stochastic and deterministic models has triggered substantial progress in several theoretical and computational fields.

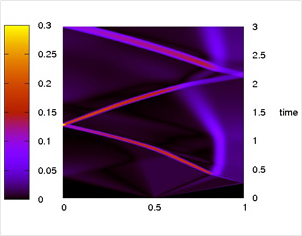

Recently, a growing attention has been devoted to Markovian dynamics to deal with processes combining stochastic and deterministic evolutions. A first important example, related for instance to dynamic reliability or to fragmentation and its numerous applications, is to consider piecewise deterministic Markov processes. Another example is the study of the transmission control protocol used for data transmission over the Internet. Further examples appear in biological models related to cell contamination, while other stochastic tree-indexed processes are encountered in aging cell detection.

In the context of computational finance, the recent financial crisis clearly demonstrated that standard pricing models can become inadequate in periods

of stress, and that a better understanding of market frictions, price formation, market makers’ behavior, and market micro-structure is crucial. More realistic models should incorporate jumps (this is especially relevant for energy and commodity markets) and provide a more accurate description of the dependence structure between assets. In connection with the increase of computational capacities, the design of optimal execution algorithms occupies a growing part of the landscape in financial mathematics and engineering. Modeling and analysis of the dynamics of order books and of market micro-structure are crucial.

Scientific program of the Bézout Labex

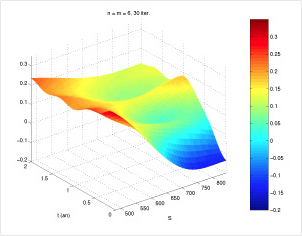

In the context of computational models, a first important issue is the approximation of high-dimensional problems which may be probabilistic in nature. The numerical analysis of new developed schemes, as well as their improvement in view of high-performance computing, are key tasks to be undertaken. A first important example is uncertainty quantification and propagation in applied sciences. The Labex teams also plan to develop and analyze greedy algorithms to compute reduced bases and thereby to achieve substantial reductions of computational costs. Nonlinear PDEs arising from Newtonian and non Newtonian flows deserve further investigation from both theoretical and numerical viewpoints. Other applications to be explored are environmental and urban flows caused by intense rainfall events or floods, soil erosion caused by overland flows, and environmental impact of underground waste storage.

In the context of Markovian dynamics, better understanding in long-time behavior should lead to new results in very different applied fields such as physics, polymeric fluid flows, particles approximation of nonlinear PDEs, or transmission control protocol. Such studies are also fundamental for the understanding of metastable dynamics, which are often encountered in molecular dynamics. The Labex teams also expect to develop new results in the field of piecewise deterministic Markov processes.

In the context of Computational finance and more generally stochastic differential equations, the Labex teams intend to provide new contributions on the modeling with jump processes and Malliavin calculus, as well as to contribute in the modeling and the control of systemic risk.

Valorization of results, transfer, and expertise

The Labex’s work on mathematical finance will have a sizeable impact in the sector of banks and insurance. Current examples include the development by the Mathrisk project team (continuation of the old Mathfi project) of the software PREMIA (cf.https://www.rocq.inria.fr/mathfi/Premia/) for option pricing and collaborations with several banks.

The work on computational methods in the applied sciences will hinge on several fields of expertise which are currently being developed in close collaboration with industry. Current collaborations include among others CEA, EADS, EDF and other partners.